BUDGET MALAYSIA: how much should you budget to live in Malaysia?

Salam alaykum, selamat datang to everyone!

Today, we are going to share with you our budget estimates for living in Malaysia: we are going to try to make it as simple as possible, without going into too much detail.

As usual, before starting, for those who join us, know that we are a mixed French family.

We left France in 2020.

Asmae is of Moroccan origin, I am Cambodian and I also have Malaysian family here.

So let’s see what budget Malaysia should you prepare for your expatriation to Malaysia?

Putting these Malaysia budget estimates into perspective

In this video, we’ll do a monthly expense estimate. I say estimate, because your personal situation and lifestyle are probably not the same as ours.

All estimates will be based on the following configuration: a couple, with one child.

We have made an estimate for 3 different profiles so that this video can benefit as many people as possible:

- First profile: the budget for a comfortable lifestyle.

- Second profile: the budget for a minimum lifestyle.

- Last profile: the budget for a very comfortable lifestyle.

We’ll start right away with the first profile.

How much does it take to live comfortably in Malaysia?

In this first part, we have based ourselves on our lifestyle, which we consider comfortable, al hamdoulillah.

What is living comfortably?

Living comfortably is different from one person to another.

For us, we decided to

leave France

for several reasons, in particular for a better comfort of life.

In short, one of the objectives (not the only one) was to “upgrade” our daily life. To allow ourselves to do things that we would not normally be able to do in France.

For example, going to restaurants with your family on a regular basis, spending weekends in nice hotels, delegating housework to a cleaning lady, enjoying while saving money, etc.

Let’s move on to the expense items for this first type of profile.

We’ve made some great slides so you can easily follow the video ????

Don’t forget that all this information is available on our website.

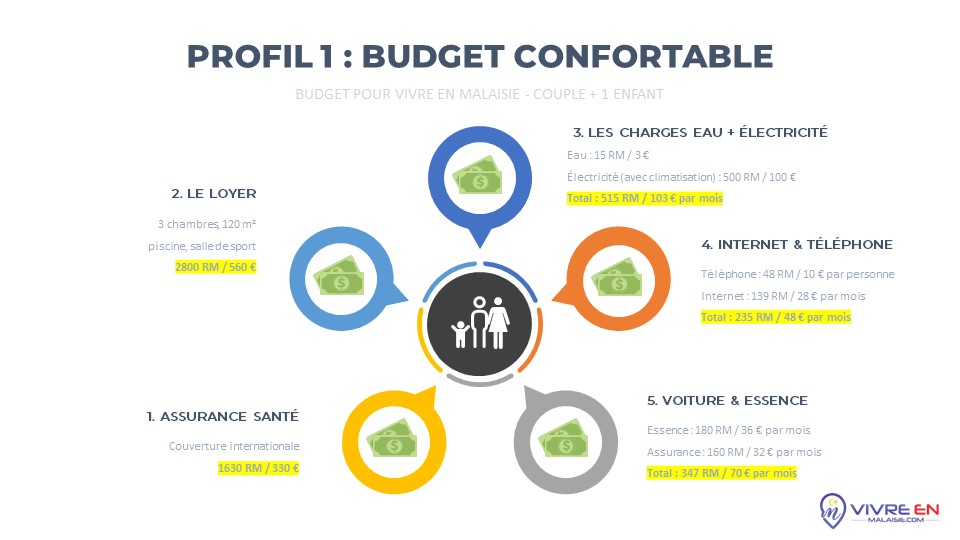

1. Health insurance

We did not choose the offer with the maximum protection, but the offer that was closer to our needs, no more, no less.

If you want to know more about the

expatriate health insurance

you can watch our 35 minute video on this subject. I put the link in comment.

Per month, we are at 291€ for the whole family.

Hospitalization is covered at 100%.

While consultations, medication, etc. are partially reimbursed.

So, we’ll say that you have to add (this is an estimate, again) about RM200 per month.

These RM 200 correspond to the remaining costs to be paid for medication and consultations (pediatrician, general practitioner, etc.).

So, in the end, for the health budget, plan for a couple with one child, 1630 RM / 330 €.

2. The rent

For a condominium apartment, with pool, gym, game room, etc., count RM2800 / €560.

This includes the various charges excluding water and electricity: access to various amenities, parking, etc.

Again, you can find cheaper and more expensive.

But if you start with a budget of RM 2500-3200, you should find a rather comfortable 3 bedroom apartment in Kuala Lumpur.

I won’t go into details, as we have made a series of videos about apartments in Kuala Lumpur.

We will be shooting other videos soon as well, especially for furnished apartments and houses.

3. The different charges: electricity and water

- For water, it is very low.

It costs about RM 15 / € 3 per month.

As a reminder, tap water is not drinkable. - For electricity, everything will depend on the use of air conditioning.

In our case, we use air conditioning a lot, but as time goes by, depending on the person, you will get used to the heat and therefore you will use air conditioning less and less. You can also replace it with the fan.

For 3 rooms, expect to pay around RM600, if the air conditioning runs all night in one room, and a good majority of the day in the living room and one bedroom.

So, for water and electricity, count RM 615 / € 123 per month.

4. Telephone and internet packages

For the telephone, count about 48 RM per person, for an unlimited internet package.

We have written a very detailed article on the different offers on the market for the choice of your telephone subscription.

In this article, we detail the quality of the network, the speed, and the price.

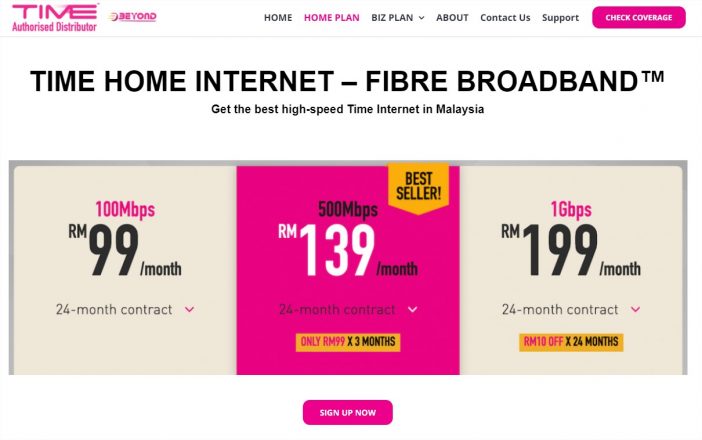

For internet, the most used provider in Malaysia, especially for fiber, we use TIME.

It offers three different packages.

Since we work on the internet, it was essential to have a very good connection.

We took the intermediate offer at RM 139 per month.

In total, we are therefore at 235 RM / 48 € per month.

5. The car: gas and insurance

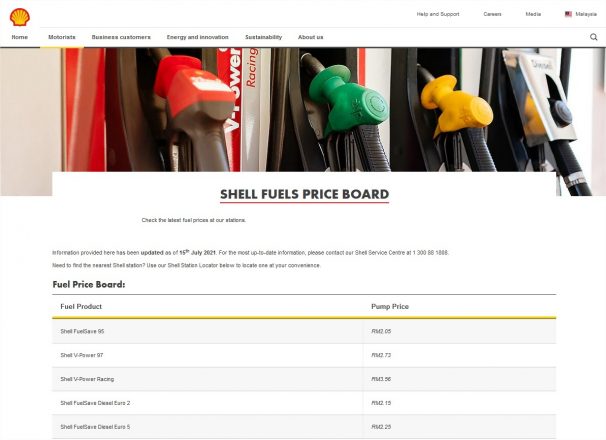

- For gasoline, it will depend again on your use.

But the

gasoline prices in Malaysia

is really low compared to France.

We made a video for the price of gas.

A liter of gasoline is currently RM2.05, or €0.41.

Count on average 18€ the full tank, all will depend once again, on the type of vehicle.

So per month, if you fill up twice, it would cost you RM 180 / € 36 per month.

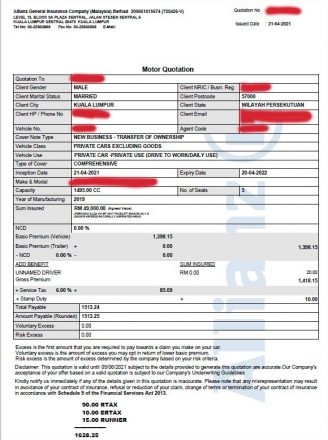

- For insurance, it will also depend on your type of vehicle.

The first year, you will not benefit from any bonus, so you will pay the full rate.

For an average car, very recent (2 years old), with a value of 50,000 RM / 10,000 €, count about 160 RM / 32 € per month, for a correct coverage.

There are different taxes that I include in this price, for simplicity.

Budget Malaysia – Car insurance rates

This brings the total car budget for insurance + gas + taxes to RM 347 / € 70 per month.

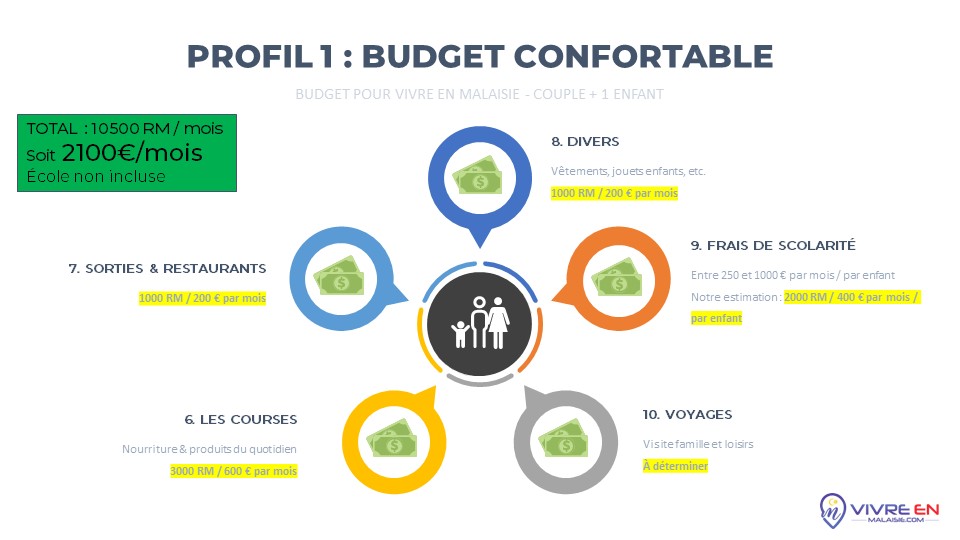

6. Daily life: shopping

This budget item is the most important one, at least for us.

In this budget item, we include food (fruits, vegetables, meats, etc.) but also essential products (baby diapers, hygiene, etc.).

We shop mainly in traditional stores, where most of the locals also come to buy.

On the other hand, for certain products that cannot be found in these supermarkets, we buy them in stores oriented for expatriates.

In this budget, we also included all the small expenses at the local grocery store, such as the 7 eleven downstairs from our residence.

We estimate these expenses to be around RM 3000 / € 600 per month.

Some will say it’s huge, others will say it’s reasonable.

7. Outings and restaurants

It’s hard to give an estimate, but if you regularly order food online, or if you regularly eat out, you can start with a budget of RM 1000 / € 200 per month.

Of course, it can be much more than that, depending on your lifestyle.

8. Miscellaneous

In this category, we have classified the various purchases we make on Lazada or Shopee (equivalent of Amazon if you want…).

It can also be clothes or toys for children for example.

Estimated at 1000 RM / 200 € per month.

9. Tuition fees: the school

We put it at the end, because it doesn’t apply to everyone.

Most importantly, fees vary greatly depending on the school you choose.

In our case, the estimate is 2000 RM / 400 € per month, for an international, Islamic school.

As an indication, the tuition fees for a student in a French high school start at RM 2700 / € 550 per month minimum.

The final budget to live well in Malaysia

If we add it all up, it would come to almost 2200 € / month.

We have not included the tuition fees: you can add them according to your personal situation.

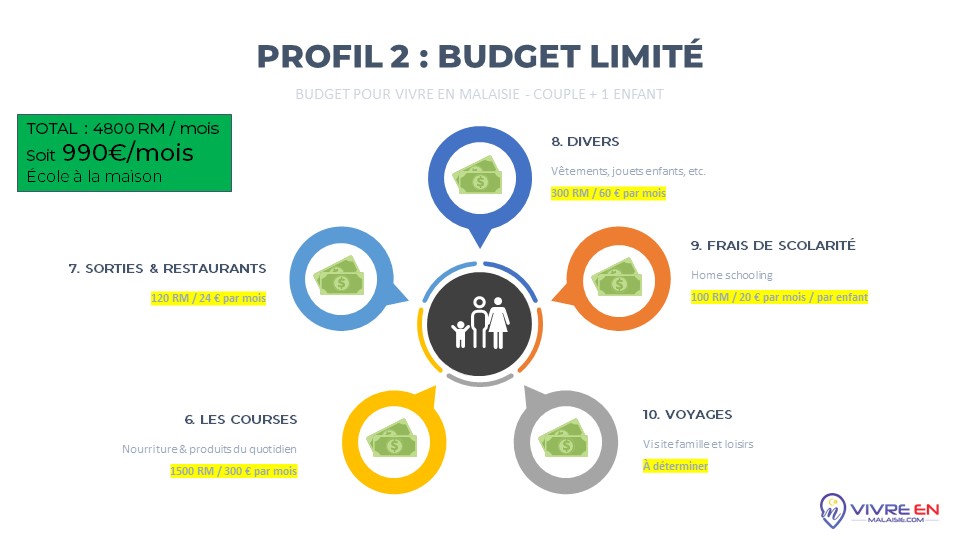

How much does it take to live at least in Malaysia?

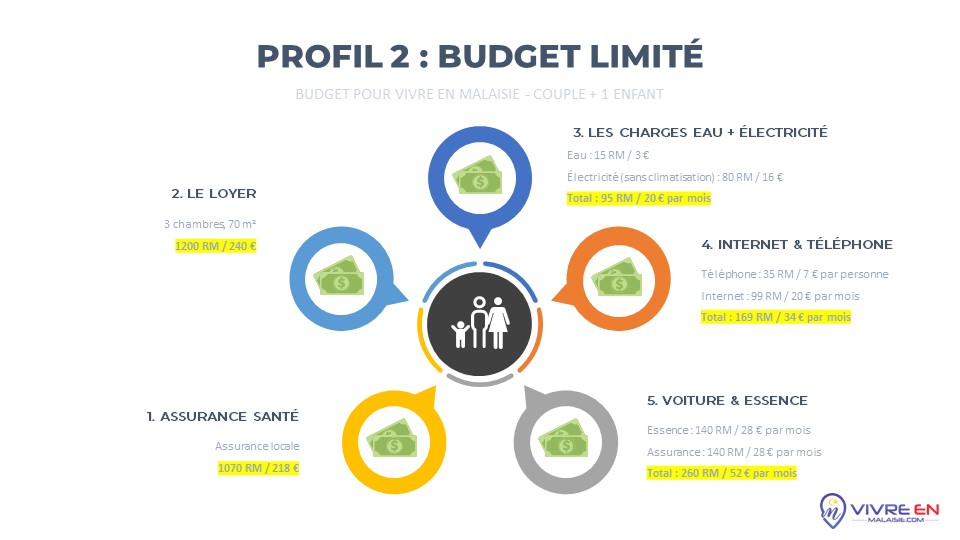

In this second part, we have based ourselves on a restricted lifestyle.

We made an estimate, still for a couple with 1 child.

This way of life could be of interest to the most modest families, but we prefer to warn you, you must be prepared to make sacrifices.

Especially since you will be far from your native country (probably France or an African country for most of our subscribers), and in case of difficulty, you will not have your immediate family or relatives to help you.

What does it mean to live with the bare minimum?

In this simulation, we have based ourselves on the bare minimum to live in Malaysia.

No or very little going out, eating and living like a local, etc.

1. Health insurance

We chose an offer from a local Malaysian insurance company, in this case, Prudential.

The chosen formula covers the totality of the hospitalization expenses.

No coverage on current medicine etc.

Each member of the family must subscribe to a health contract: it is not a comprehensive offer for the whole family.

We do not recommend that you skip health insurance.

We will not give too many details, but for the whole family, it will be necessary to foresee for a couple with one child, approximately 670 RM / 135 € per month.

This insurance does not cover consultations, medication, dentistry, etc.

We will estimate these costs at approximately RM400 per month. With a child, you will not be able to avoid visits to the pediatrician or general practitioner if necessary.

If we add these unreimbursed health costs, it would come to RM 1070 / € 218 per month.

2. The rent

For a very simple apartment, on Cyberjaya, about 30 minutes from Kuala Lumpur, 3 bedrooms, about 70 m², count about 1200 RM / 240 €.

Again, you can find cheaper and more expensive.

If you have a little more budget, you can find a 3 bedroom apartment of about 100 m², with a pool, and a gym, for about RM 1700 / € 340 per month.

For example, in the Cristal Serin Residence: we visited it and filmed the residence.

You can find the video on our Youtube channel.

3. The different charges: electricity and water

- For water, we will stay on the 15 RM / 3 € per month.

- For electricity, we will remove the air conditioning charges.

We estimate the cost at RM 80 / € 16 per month.

So, for water and electricity, count 95 RM / 20 € per month.

4. Telephone and internet packages

- For the phone, we will stay on an unlimited data plan, but with a more restricted speed: 3 mbps, which should be more than enough for daily use, outside, because at home, you will have internet with your wifi connection.

For this, we have selected the Celcom package at RM 35 / € 7 per month.

For 2 people, this would be RM 70 / € 14 per month. - As for your internet subscription, let’s keep the same provider as before, TIME.

But we will select the first formula, which is also largely sufficient with a maximum speed of 100 Mbps.

Please check if you are eligible in your residence.

This package is 99 RM / 20€ per month.

In total, we are therefore at 169 RM / 34 € per month.

5. The car: gas and insurance

- For gasoline, we’ll revise it down slightly, assuming you’ll be moving less than in the previous simulation.

That is 140 RM / 28 € per month.

- For the insurance, if you take an old car, with low value, the insurance will be inevitably less expensive.

If you decide to settle on Cyberjaya, the car becomes essential.

However, you can use the Grab (equivalent to Uber) from time to time: it can be cheaper if you don’t travel a lot.

We will make an estimate of about RM 120 / € 24 per month, for a proper insurance.

This brings the total car budget insurance + gas + taxes to 260 RM / 52 € per month.

6. Daily life

If you only consume locally, or if you really do live on the minimum, then this budget item could be much lower than in the first simulation.

Let’s estimate these expenses at about RM 1500 / € 300 per month.

Again, it is very difficult to make an accurate estimate without knowing your lifestyle.

7. Outings and restaurants

We will not completely eliminate this expense even though it is not strictly necessary for many people.

One of the many advantages we enjoy in Malaysia is that no matter what your social class is, you can always go out and enjoy a few pleasures a month.

Here, it will be rather local street food.

If we assume that a meal costs 10 RM / 2 € per person, and that you allow yourself one family outing per week, then it would cost you about 120 RM / 24 € per month.

8. Miscellaneous

In this category, we will minimize these expenses.

Estimated at 300 RM / 60 € per month.

9. Tuition: Homeschooling

We are starting out on a home schooling basis.

For the various fees (online course registration, various school supplies, etc.), let’s start with an estimate of RM100 / €20 per month.

The final budget to live with the bare minimum in Malaysia

If we add it all up, it would come to almost 1000 € / month.

Let’s move on to the last case: the wealthy family with a very comfortable budget.

How much does it take to live very comfortably in Malaysia?

This third part will be done in another article and video, so as not to clutter up the information too much.

We will make an estimate for a very comfortable life in Malaysia: large house, with private pool, cleaning lady, gardener, pool attendant, full health insurance, etc.

Knowing that the majority of the people who follow us are rather part of the 2 categories above.

Conclusion on the Malaysia budget

We hope that the information in this article and video will be useful in your eventual

expatriation procedures to Malaysia

.

We could have entitled the title“the budget to live on Kuala Lumpur” but for many people, Malaysia stops at the

capital of Malaysia

.

You can live even cheaper in other cities in Malaysia.

The budget is not a sufficient condition to come and live in Malaysia

Keep in mind that this video is only about the monthly budget in Malaysia.

This does not include the settling-in costs that many people forget to plan for: when you arrive in a new country, you need to budget for various expenses.

This could be visa fees, rent advances, furnishing your apartment, buying a car, or even small items such as a toolbox, appliances if needed, etc.

Only you know exactly what your needs are and therefore your approximate budget.

We advise you to create an Excel file, and adjust the different expenses listed in this video.

Keep this file with you, and depending on the evolution of your project, you can edit it permanently.

As a reminder, budget will probably not be an issue for the majority of people who will watch this video.

The biggest barrier to move and live in Malaysia is and will always be to obtain a

RESIDENCE VISA in Malaysia

.

Our goal through this

Youtube channel

and our social networks is to guide a maximum of people in their search for information about Malaysia.

We would like to thank the people who follow us more and more on the networks.

And we apologize if unfortunately we can’t answer all your questions individually.

Advice

Finally, keep in mind that an expatriation is never final: you can always back out or plan B.

Failure is not inevitable.

On the other hand, not trying can be worse than failing.

An expatriation requires a lot of preparation, effort and sacrifice.

Not everyone is cut out for expatriation.

For the Muslims who are following us, may Allah make it easier for you to make your plans, whether it is for expatriation to Malaysia or elsewhere.

For non-Muslims, we wish you the same, remember that time is running out very quickly.